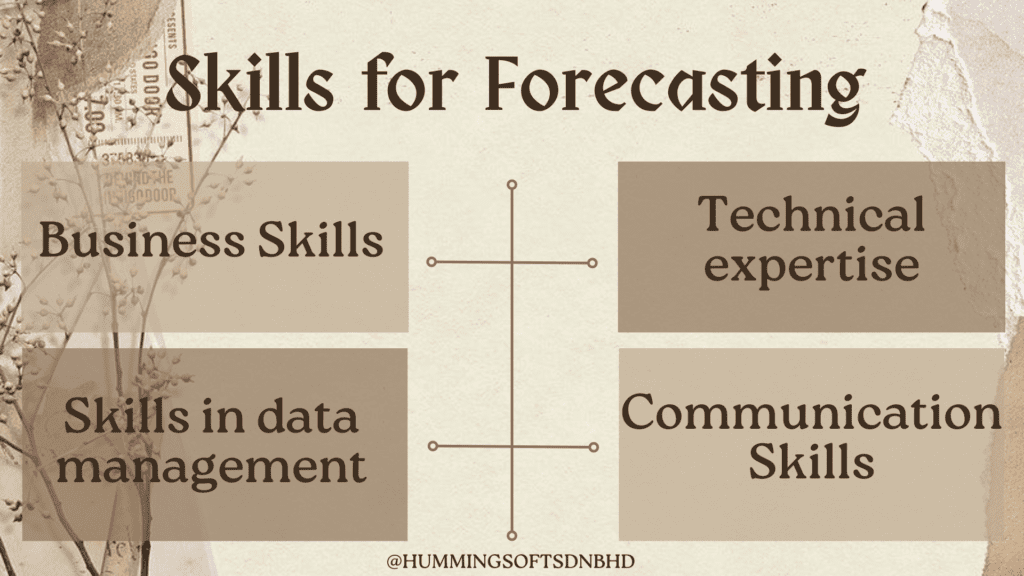

All investment, whether it be in the stock market, investment banking, real estate, venture capital, network marketing, business ownership, or something else entirely, relies heavily on forecasting. The following abilities are crucial for investors to have to make precise forecasts:

Business Skills

All types of investors benefit from having a thorough awareness of the market and the company environment. The accuracy of the investor’s forecast depends on their grasp of the wider picture, which enables them to choose the most appropriate forecasting approach and strategy for each case, regardless of the type and purpose of the investment.

Technical expertise

An investor must possess the technical expertise necessary to recognise pertinent data, aggregate it, and form beneficial inferences before they can generate an accurate and pertinent projection.

Skills in data management

Data is the foundation of all forecasts, therefore before gaining insight into prospective future developments, an investor must be able to recognise, organise, and manage all the pertinent data. This entails not only using the data to build accurate forecasts of future events but also enhancing the quality of the data by identifying and removing any anomalies.

Communication Skills

Interpersonal and communication skills are important qualities for any investor. Every stage of a forecast, from data collection to explaining the forecast’s findings to outside parties, requires communication. Investors will utilise their communication skills to connect with pertinent business units, secure funds for investments, and inform pertinent parties—such as partners and company CEOs—of the forecast’s conclusion.